7 Lessons On Strategies

The Rich Use To Buy Annuities

Lesson #7

Advanced Annuity Plan Case Study

Review a case study based on real life scenarios using the advanced annuity

planning techniques discussed throughout these 7 lessons; and experience first hand the powerful results that can be achieved through the correct use of annuities during retirement.

Case Study Assumptions

In this lesson we will review a real life case study that showcases the advantages of using a laddered annuity strategy with a recovery of principal leg during retirement.

So let’s jump right in…

Case Study 1 Assumptions:

Bill & Sue Johnson, Ages 60 & 61, both in excellent health.

Total Household Traditional IRA Position: $1,000,000

Total Household Non-Qualified Position: $350,000

Total Household Roth IRA Position: $0

Current Retirement Income Sources:

His SS $3,400

Her SS $1,800

Small Pension $650

TOTAL Current Retirement Income: $5,850

TOTAL Needed Retirement Income: $10,000

Income Shortfall: $4,150

Primary Needs & Concerns:

- The Johnsons are 5 years away from retirement (at age 65) and are very concerned about safety of principal and the potential risk of taking another big loss in the stock market this close to retirement.

- Starting at age 65, they would like to generate at least another $5,000 a month of income, to supplement their pension and SS, but they are also concerned about inflation and want their income to get bigger throughout their retirement.

- They worry about taxes because they realize so much of their money is concentrated in traditional IRA's and know they will have an RMD burden down the road.

- They would like to preserve as much principal as possible to pass down to their 4 children and 8 grandchildren but worry that the estate is also going to be eaten up by taxes.

Solution: A Five-Leg Laddered Plan To Address All Their Needs

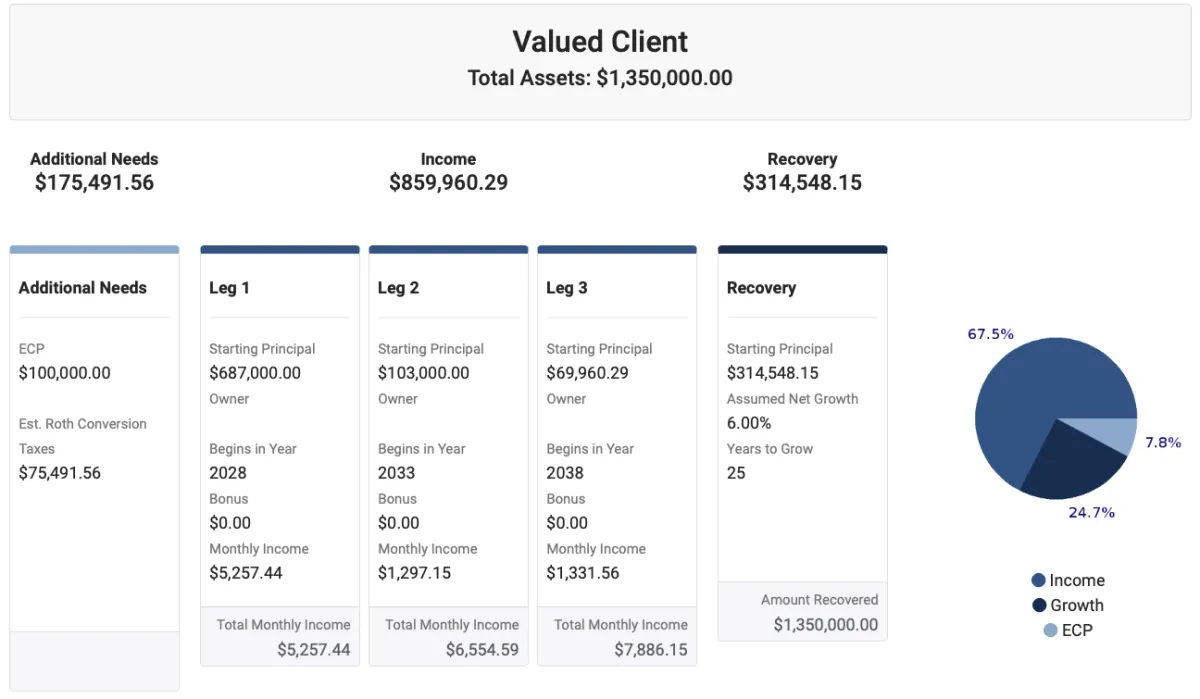

STEP ONE: We separate their overall portfolio of $1,350,000 into three primary categories or segments:

Additional Needs: $175,491.56

Assets for Income Production: $859,960.29

Assets for Recovery of Principal (growth): $314,548.15

:The Additional Needs Segment contains $100,000 of cash that we set aside purely for emergencies throughout retirement (we call this the Emergency Cash Position or ECP for short) as well as an additional $75,491.56, which is the estimated conversion tax bill needed to convert the Recovery Leg (the $314,548.15 in the last leg) into a Roth IRA (more on this in a minute).

This total amount of $175,491.56 came from their $350,000 of non-qualified after-tax money.

SECOND: the Income Assets of $859,960.29 is further divided into 3 separate annuity legs.

Annuity Leg 1 is initially funded with $687,000 of IRA principal, which receives a guaranteed annual compounding growth rate of 8% on their future income payout, thereby allowing it to begin paying a joint guaranteed lifetime income stream at age 65 of $5,257.44 (remember their goal was at least another $5,000 of monthly income)

Annuity Leg 2 is funded with $103,000 of IRA money, but it is going to receive the 8% growth rate for 10 full years until age 70. At that time, it will also turn on joint lifetime income and provide a significant inflation adjustment, by adding an additional $1,297.15 per month of income to their existing $5,257.44, thereby boosting their total lifetime annuity income to $6,554.59.

That is a 25% RAISE in their annuity income that automatically occurs at age 70, regardless of whether the stock market is performing well during that time frame or not!

Annuity Leg 3 is initially funded with $69,960.29, grows for 15 years at an 8% compounding return, and then provides $1,331.56 of monthly joint lifetime income starting at age 75. This is another 20% inflation adjustment to their overall annuity income, bringing their total monthly joint lifetime annuity income to $7,886.15 per month.

THIRD: the Recovery Leg of the plan was originally funded with $314,548.15 of traditional IRA money, that we converted to a Roth IRA initially when we first set up the plan. The purpose of the Recovery Leg is to enjoy undisturbed compound interest for a 25 year period, which, at only a humble 6% assumed rate of return, would re-grow or "recover" the original $1,350,000 of lump sump principal they started retirement with, by age 85!

However, because the Recovery Leg was funded with a Roth IRA, it has now regrown completely income tax free and RMD free, and can even be left to their heirs completely income tax free as well. This only cost them $75,000 in taxes initially in order to pass down $1,350,000 tax-free to their children and grandchildren!

Take a moment and re-read the breakdown we just described, if needed, and note how it looks visually in the proposal example below:

This is a mathematically correct solution that addresses and solves every one of the Johnson's key priorities at the same time:

-It provides safety of principal by shifting a substantial percentage of their portfolio into guaranteed annuities issued by A+ rated insurance companies- that are never affected by stock market volatility.

-It provides not only their minimum target income of $5,000 per month of supplemental income, but it has built in inflation adjustments at the 5 year and 10 year mark of retirement so their income can grow and get bigger over time - as they requested.

-It solves the fear of running out of money by not only providing lifetime income that will never turn off no matter how long they live, but we are also preserving and recovering 100% of their original principal tax-free at the other end, so they literally can't run out of money.

-It meets their stated goal of maximizing the estate by legally cutting the IRS out of the inheritance. By performing a Roth conversion of the Recovery Leg upon initial setup, the Johnson's get to enjoy 25 years of tax-free compound interest, it removes the burden of the required minimum distribution that normally would be due on traditional IRA funds (because Roth IRA's are exempt from the RMD), and it allows the entire recovered balance to pass down tax-free to their children and grandchildren.

These types of laddered income portfolios can be built for anyone:

- between the ages of 50-80

- who have at least $150,000+ of investable assets

-it can be built with 401k or employer-sponsored plan rollovers, IRA's, Roth IRA's, Non-Qualified (after-tax money) or a combination of any of these.

- these plans can also still work in many cases where you may already have existing annuities, by building a more comprehensive ladder around the existing annuity or annuities you may already own.

The planning software we utilize enables us to help you easily experiment with multiple customizations and variations of this concept so we can really dial it in to the mathematical sweet spot you are looking for.

The easiest way to do this is over a complimentary strategy session that we offer via a Zoom computer meeting.

This enables us to put the visual example right up on the screen for you, and help you adjust and refine the strategy until it's producing the maximum income and preservation of principal results that best align with your priorities and requirements.

So I'd like to personally invite you to book a strategy session visual demo call with me. Let's see how this concept can help you solve your most pressing retirement concerns.

At the end of the session, I send you a PDF of your custom laddering strategy without cost or obligation, and I leave it completely up to you to decide if it makes sense for us to proceed any further beyond the initial session.

The link to my calendar is located just below, so please feel free to select a time for us to connect on a complimentary Zoom call.

I look forward to speaking with you and sharing some helpful ideas for your retirement.

Also, I hope you enjoyed this course and found it informative. I would love to hear your feedback, as well as whether you have any additional suggestions or requests on additional material you would be interested in me covering in future educational content.

I look forward to connecting with you soon!

Paul

Paul Spurlock

Licensed Insurance Agent

Paul@NationalAnnuityEducators.com

(919) 780-8395

Paul D. Spurlock, CRPC

Retirement Income Specialist

info@NationalAnnuityEducators.com

(919) 780-8395